Peerless Info About How To Appeal An Appraisal

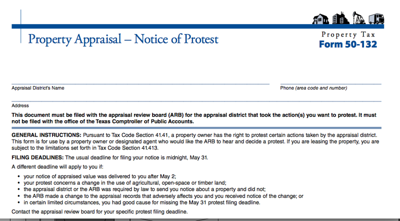

By law appeals may be filed by july 1st of each year but no later than 60.

How to appeal an appraisal. Transfer of ownership, leasing, and other issues may require you or an agency to have a better idea of your minerals'. Residential property, you must appeal to the small claims division before proceeding to bota. Make sure to do so within the appeal period.

But the property tax system is somewhat labyrinthine. Check your property tax assessor’s website. Your first step in appealing your appraisal is to collect concrete evidence that it is inaccurate.

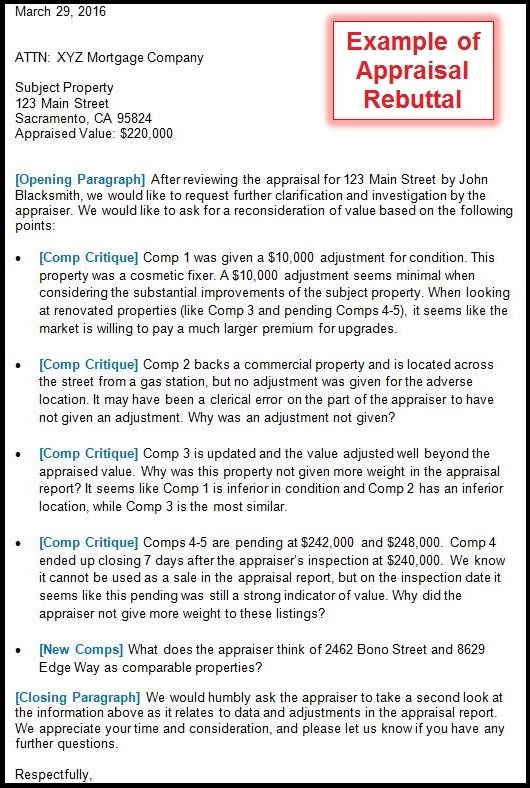

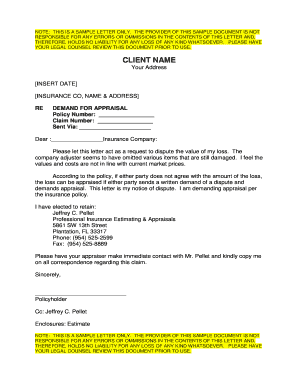

In many cases, a formal letter of appeal is required. Your appeal letter should be written in block style, with all text justified to the left. There’s absolutely nothing fun about it!

Appealing your va home appraisal when a va appraisal fails to meet the home’s purchase price, the buyer or seller party may request a formal reconsideration of value. Single space the content, with a double. To appeal an arb order to binding arbitration, you must file a request for binding arbitration with the appraisal district not later than the 60th day after receiving notice of the order.

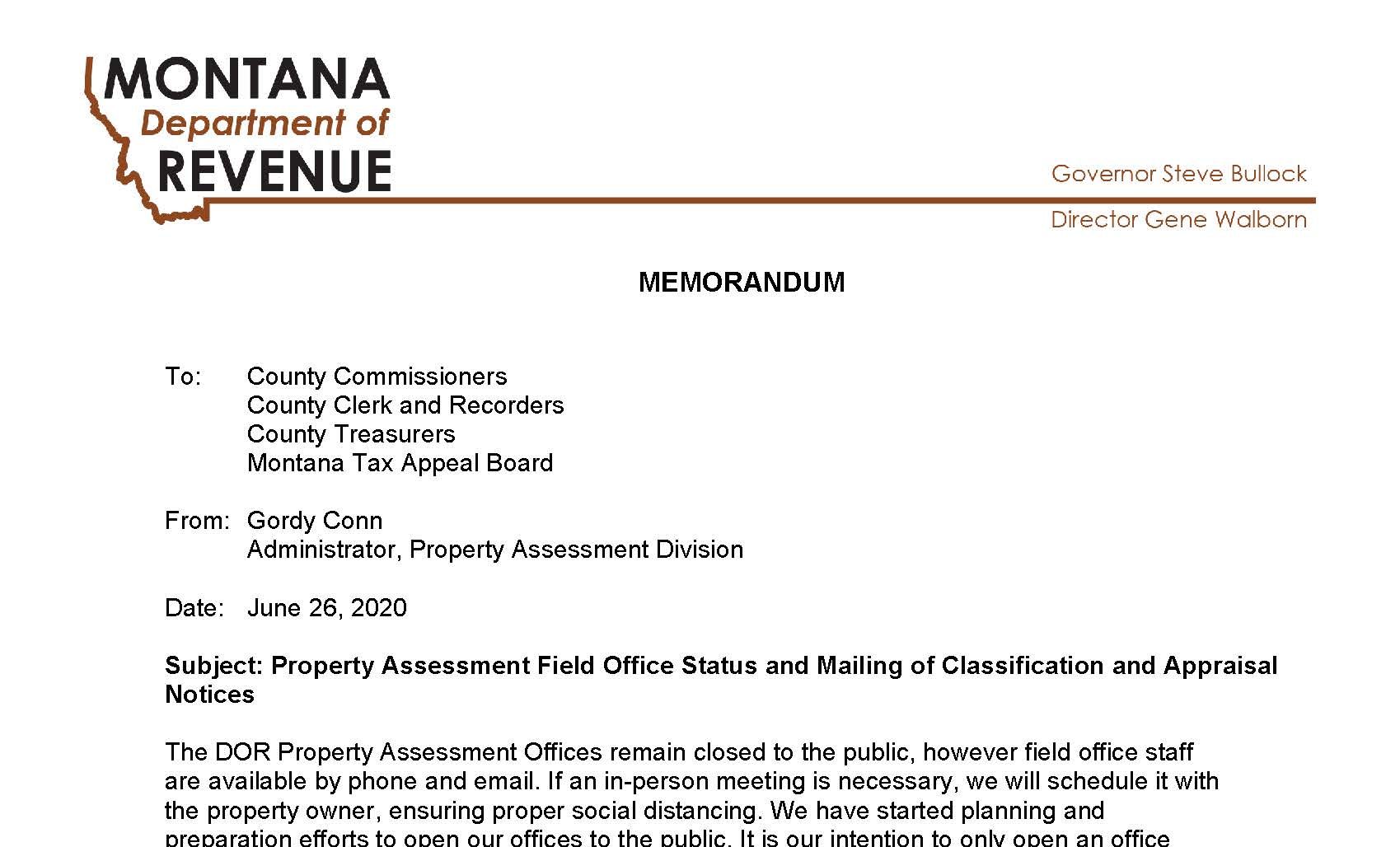

How to appeal a home appraisal review the appraisal. If you elect to formally challenge your property assessment, you must file an appeal with your local appeals board. Property tax appeal procedures vary from jurisdiction to jurisdiction.

Instead, in order to have any hope of overturning an appraiser's opinion, gather concrete evidence, including different data than the appraiser used. How to appeal your property tax assessment 1. Taxpayers can file appeal online using: