Ace Info About How To Settle Insurance Claims

Before you settle your auto accident claim with a lawyer, there are several important steps you need to take.

How to settle insurance claims. Our clients share the view opinion that the best course of action in settling a claim is engage icrs public insurance adjusters at the beginning of a claim, present evidence that supports the. Settling an auto insurance claim quickly might sound impossible, but it’s not. Since state laws vary, make sure you check with the insurance commissioner's office in your state to see whether there are any other steps you need to take to settle the.

When writing an insurance demand letter, you will have to state what your insurance claim is worth. Keep track of all the details of the incident regardless of how. You must have substantial evidence supporting your case to settle your insurance claim effectively.

What are the 4 steps in settlement of an insurance claim? Insurance claim timeline in illinois. Geico insurance adjusters enter in several factors of the car insurance claim into their claims software and the software will spit out a settlement range where the adjuster can.

Negotiating a settlement with an insurance company. Include the names of the parties involved in the accident, the date of the accident, and the insurance claim number. The exact process can vary.

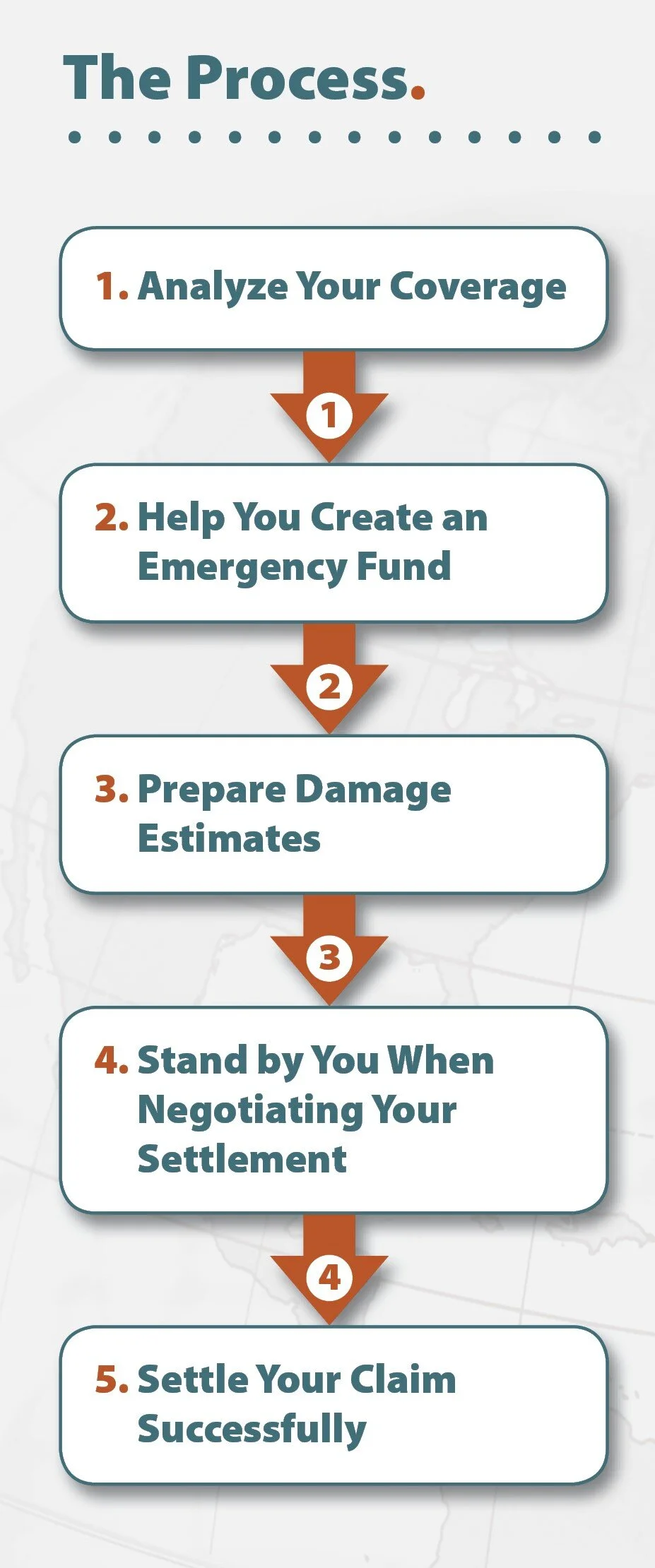

Through a personal injury insurance settlement or a civil lawsuit in court. Ask them if another adjuster can review your claim in case the first one has. In order to settle an insurance claim, you will need to prove liability, document your losses, and establish a connection between the accident and your damages.

Have a settlement amount in mind. You can also contact the insurance company's claims department and deal directly with them. Gather information needed for your claim.