What Everybody Ought To Know About How To Reduce Credit Card Rates

If you have credit card debt on multiple cards, some personal.

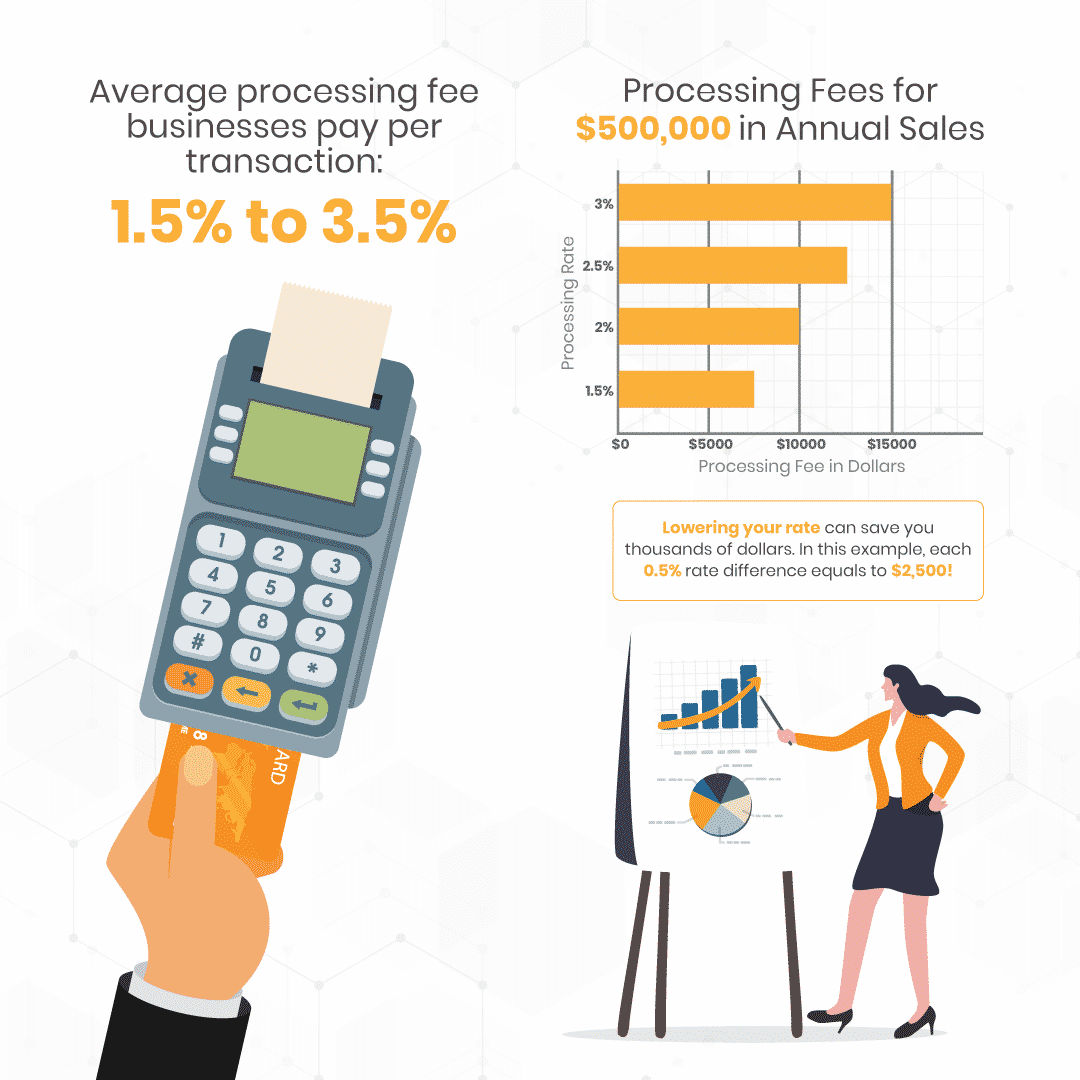

How to reduce credit card rates. Ad find credit cards with low interest rates & no fees, $200 bonuses & up to 5% cash back. But how it works is up to individual issuers, and you. 6 hours agoif you have $10,000 in credit card debt at a 17 percent interest rate and you pay $150 per month toward your balance, it’ll take 17 years (and cost $20,820 in interest) until.

See credit card benefits and find the best card offer for you. For credit cardholders facing carried balances with high interest rates, a balance transfer card option may help reduce a rate or, with the right account, provide a few months of. Ad browse these card categories:

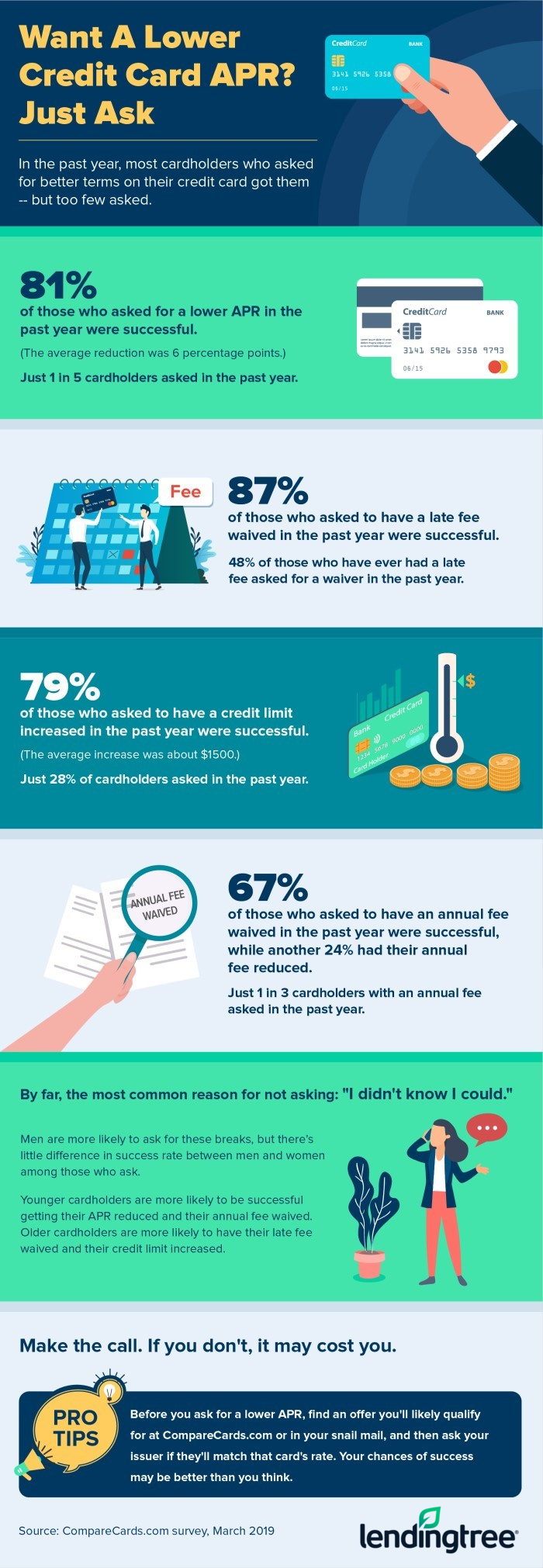

Yes, you can negotiate with your credit card company to reduce your interest. Offers include low interest rates, cash back and more. Here are some tips on how you can lower your credit card apr:

Interest free payments until 2024. Learn more & apply today. One of the simplest ways to reduce.

National debt relief receives the top ranking in our evaluation. Contact your credit card issuer and explain why you would like an interest rate. Many people don’t understand how credit card apr works.

Once you’ve researched the competition and worked to improve your chances of getting approved for a lower interest rate, it’s time to begin. Make sure to review all of your credit reports before you pick up the phone. Letter to credit card company to lower interest rate;

:max_bytes(150000):strip_icc()/pros-cons-personal-loans-vs-credit-cards-v1-4ae1318762804355a83094fcd43edb6a.png)