Amazing Tips About How To Deal With Late Credit Card Payments

Credit card late payments can happen to anyone.

How to deal with late credit card payments. If your minimum credit card payment is late, don’t panic. Credit card issuers are allowed to. The best way to deal with a delinquent.

This obviously doesn’t mean that it’s a good idea to take your time with your credit card. If you are late on a credit card payment, pay the bill immediately and can negotiate a fee waiver. Set up automatic monthly payments by linking directly to your bank account.

Emergency medical bills, car repairs, or other sudden expenses are some of the. Citi credit card fees paid before nightfall on a typical operating day are reimbursed the same day. Waiving or refunding late fees.

If this is your first time being late on a late payment, you might be able to persuade the card issuer to waive the late fee if you call its customer service line. Turning on autopay ensures that. Codes for reporting late payments start with accounts that are 30 to 59 days past due.

Making your minimum payment on time each month is the best thing you can do to rebuild your credit. Call them and explain your. Make the payment as quickly as possible and contact your lender to see if they will remove any negative mark on.

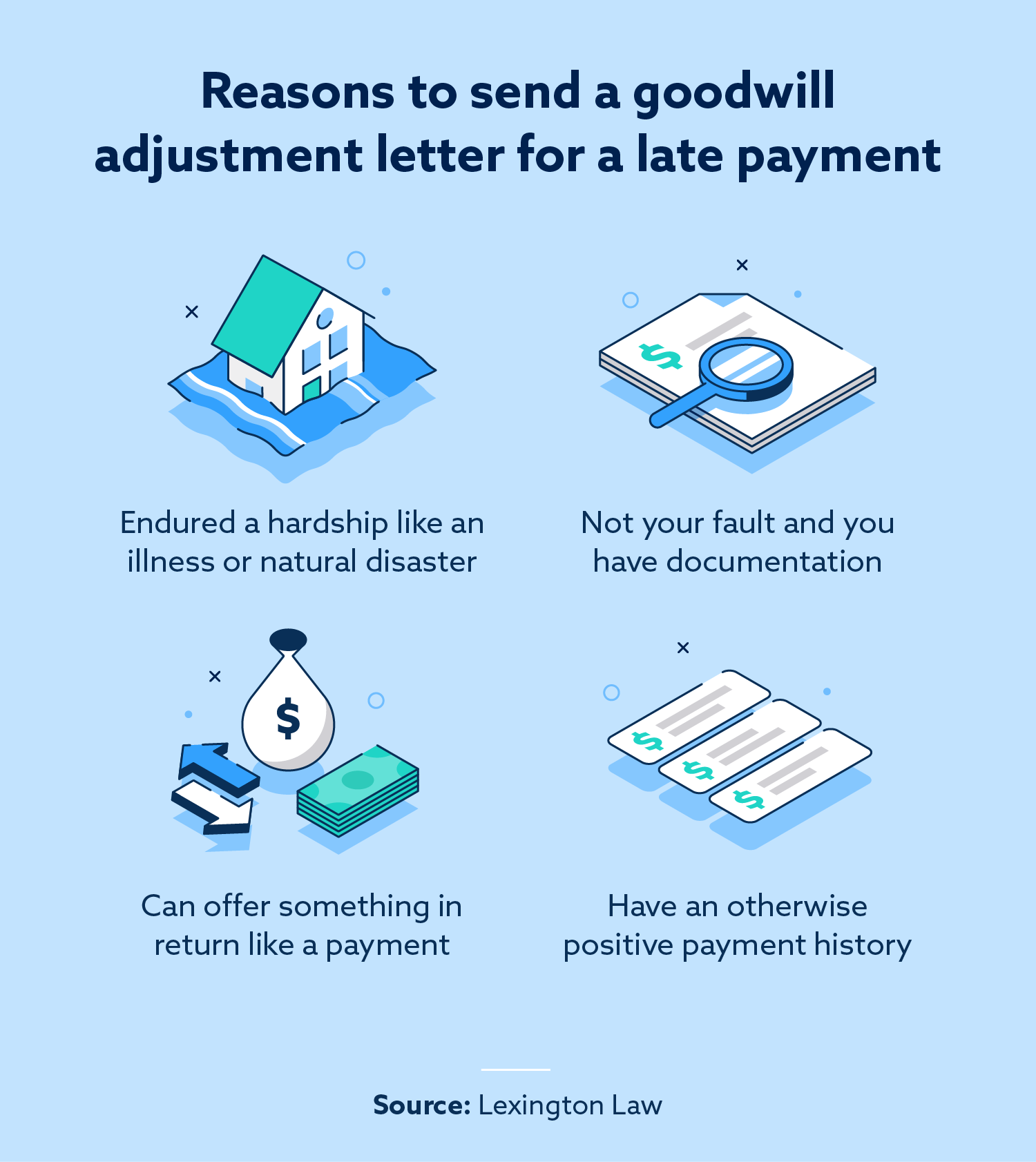

When late payments appear on your credit report, it is possible to remove them, but you must negotiate with the credit card company to do so. The best way to deal with late payments is to avoid them from the start. On the other hand, financial statements might take one to two days to change.